Opec+ is poised to lose market share to non-Opec oil producers, particularly the US, which is not bound by production quotas. The market share of Opec+ members, which stood at 53% when the group was formed in 2016, is expected to decline to 46% by 2025 and 2026, as the US ramps up oil output.

Despite Opec+ members gradually reversing the production cuts made in 2023, with supply expected to increase by 100,000 barrels per day (bpd) this year and 600,000 bpd next year, the US is not constrained by quotas and is rapidly expanding its oil production. This growing supply from non-Opec countries, including the US, will continue to erode Opec+ market share.

Choeib Boutamine, CEO of Ranadrill Consulting, highlighted that Opec+ needs to continue increasing its output to maintain its market position. «If Opec+ doesn’t take back its share, someone else will,» he warned.

In November 2023, Opec+ announced voluntary cuts of 2.2 million bpd, which are set to phase out between March 2025 and September 2025. However, experts suggest that Opec+ may delay these increases if oil prices continue to fall.

Opec+ includes 12 members, with Saudi Arabia leading the group, and 11 non-Opec countries, including Russia, Brazil, and Mexico. The US, along with Guyana, Canada, and Brazil, is expected to drive the majority of global production growth, with the EIA forecasting a 1.9 million bpd increase in world production this year and 1.6 million bpd next year.

A significant portion of this growth is attributed to the US, where oil production reached 13.2 million bpd last year, driven largely by the Permian Basin in Texas and other unconventional oil fields. The EIA predicts that the Permian Basin will account for around 50% of US oil production in the coming year.

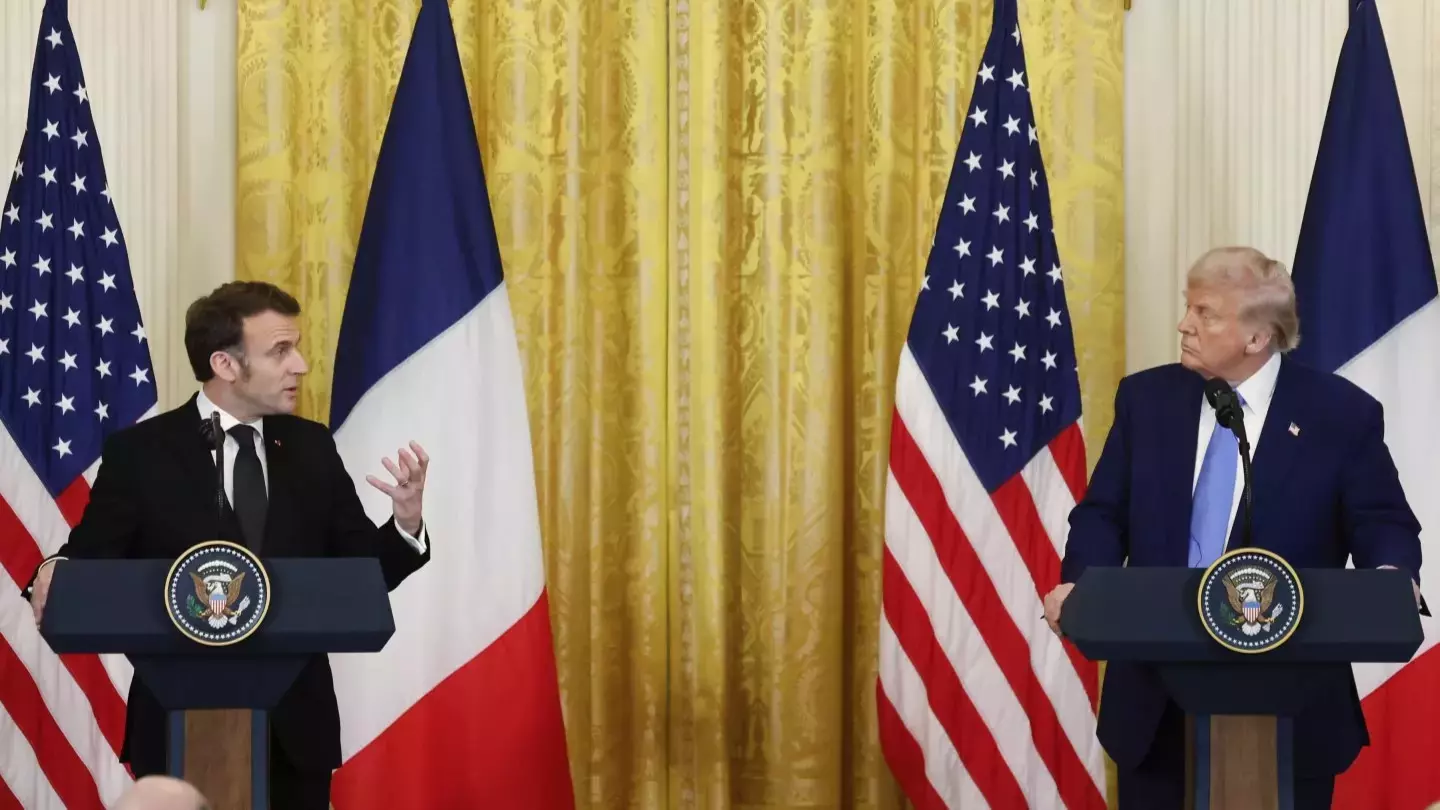

US policy under President Donald Trump is focused on maximizing domestic energy output, aiming to expand US oil hegemony. This includes reopening more than 600 million acres of offshore federal waters for oil and gas development, reversing restrictions imposed under the Biden administration. Trump’s administration is also committed to reducing Iranian oil exports, with the US Treasury Secretary indicating plans to bring Iranian exports down to just 100,000 bpd, a significant decrease from the 1.5 million bpd exported in 2024.