Adnoc Drilling is set to ramp up its investment efforts in the US and Europe in 2025, with a focus on expanding its oilfield services capabilities. The Abu Dhabi-listed company plans to allocate $700 million of its $1 billion investment budget for acquisitions, specifically targeting technology-related deals in these regions.

The company’s priority is to strengthen its position in global oilfield services, aiming to make «at least two acquisitions» this year. Youssef Salem, Adnoc Drilling’s CFO, emphasized that the focus would be on technologies related to the completion side of oilfield operations, which involves the execution of services after a well has been drilled, enabling Adnoc Drilling to offer comprehensive solutions without relying on third parties.

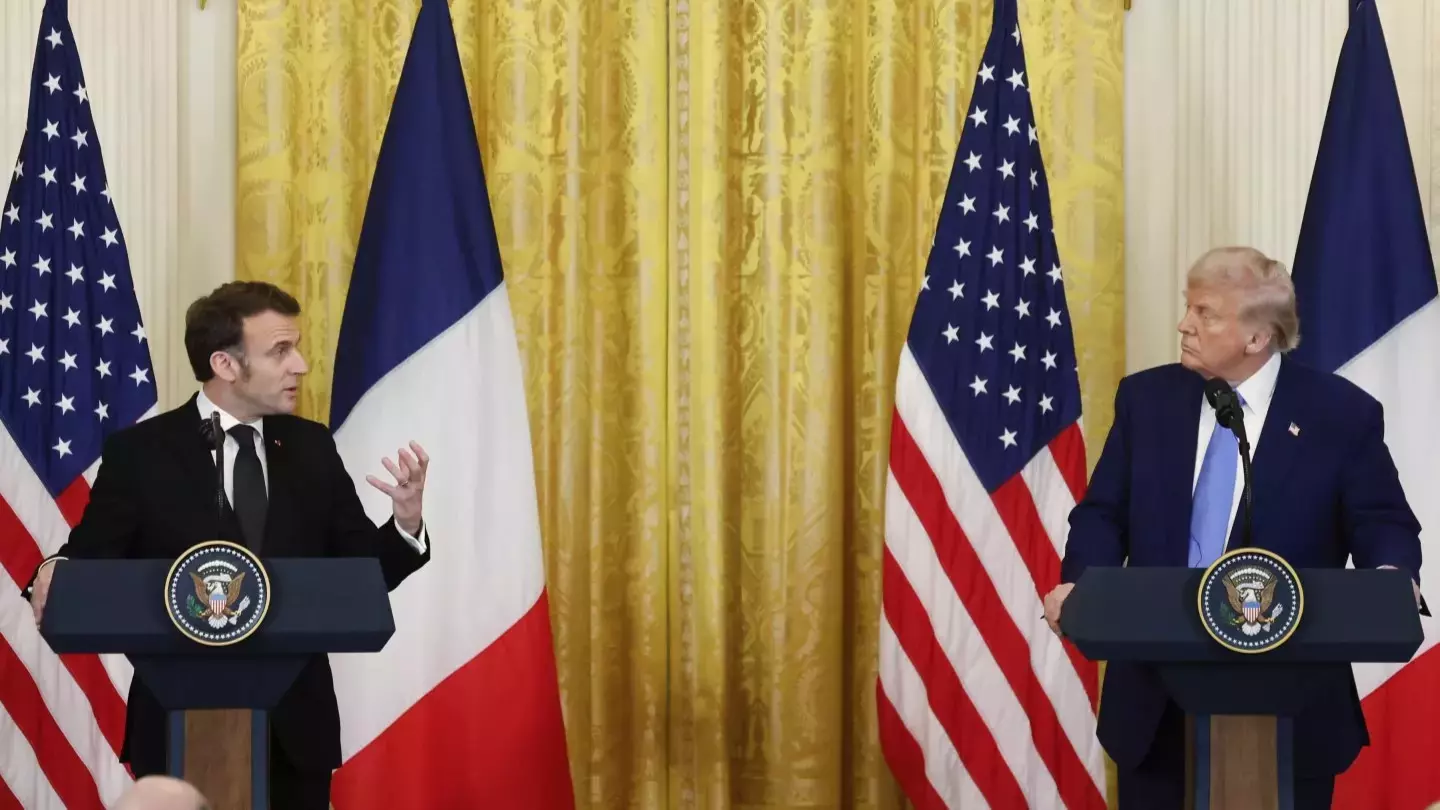

Salem noted that these acquisitions are likely to be made through Adnoc Drilling’s joint venture with Alpha Dhabi, called Enersol. Two of the four companies acquired by Enersol in 2024—Gordon and Deep Well Services—are based in the US, and both have seen increased activity, partly due to the policies under the Trump administration, which have spurred higher shale oil and gas output.

In the Gulf region, Adnoc Drilling operates in Jordan and Saudi Arabia, and the company has plans to expand into Oman and Kuwait. It has set aside between $200 million and $300 million for potential acquisitions in these markets, focusing on securing local drilling assets and companies with ready-to-operate contracts.

At the end of 2024, Adnoc Drilling owned 142 rigs, and by 2028, the company plans to expand its rig fleet to over 150. Additionally, Adnoc Drilling is working to refinance $1.25 billion in maturing debt, including a $500 million term loan and a $750 million revolving facility due by October 2025.

Adnoc Drilling continues to push forward with strategic acquisitions and investments, aiming to solidify its position in the global oilfield services market and enhance its presence in key regions such as the US, Europe, and the Gulf.